Despite the decreasing volumes, prices remain at or near record-high levels

“History doesn’t repeat itself, but it often rhymes” is a pithy saying attributed to Mark Twain and seems to apply to the regional housing market over the past several years. According to many economic pundits, when the Federal Reserve of the United States raised interest rates faster in 2022-23 than any time in the past 40 years to combat double-digit inflation, there was a belief that it would crater real estate prices. While real estate prices did stop rising at their former breakneck speed, they have not declined in any meaningful way across the United States.

So the question is, will the housing prices pop like they did in the Valley in 2008 and during the end of the tech-stock boom in 2001? Each real estate cycle might go through its ebbs and flows, but they never act in a mechanical fashion, hence the wisdom in Twain’s saying.

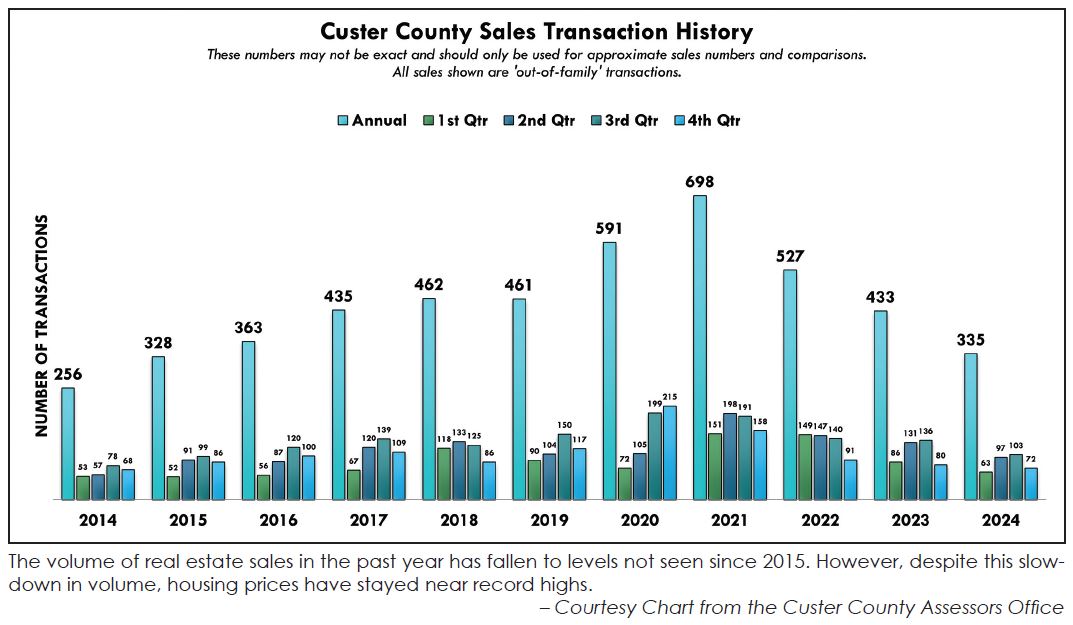

For the local real estate market, the hot market of 2020-2022 might be over, but this time, it is not prices that have fallen; instead, it is the volume of sales that has declined. While still above the low of 2009, when only 188 real estate transactions were recorded in Custer County, 2024 did mark a noticeable slowing from the all-time peak in 2021 of 698 transactions.

However, because the price of real estate has stayed near the 2021 peak, real estate agents and the local home-building industry have been able to stay busy and profitable. Talking to some real estate agents over the past few months, they all commented that valuations for real estate continue to hold ground. While the times of bidding wars for every home that came on the market ended with the rise of interest rates, sellers that place their homes for sale at the market rate are still seeing interested buyers.

In some ways, the Wet Mountain Valley region has an advantage over other markets in the United States. Here, people are often looking to retire, build a dream home, or have a place to escape urban environments for a few months out of the year. Because of this, they are often not using mortgages as the primary method of buying real estate or homes. Cash deals mean that the high lending rates are not as big of a barrier for buyers or sellers.

In addition, while the prices of local real estate can seem eye-wateringly high to locals who have lived through the last 40 years of booms and busts, the prices in neighboring Salida are almost double anything comparable to the Wet Mountain Valley region. For many places across the American West and the Denver Front Range, the Wet Mountain Valley appears more affordable to those who are not enamored with river rafting or skiing.

Builders and contractors are reporting that jobs remain plentiful, and wait times for the Valley’s experienced tradespeople run several years for getting started on a new home.

Building in the Town of Silver Cliff has been robust over the past year as Round Mountain Water was able to lift the moratorium they had in place the year before due to the aging wastewater treatment facility. Silver Cliff has been working at allowing more density on its many vacant properties, and there are now half a dozen buildings, some of them duplexes, being finished.

One of the most considerable headwinds to the housing market in the region is more silent and often overlooked unless there is a massive wildfire burning somewhere in the Western United States. According to research from the Rocky Mountain Insurance Association, average premiums for homeowners have increased 57.9% since 2019. And it is not just wildfires that are to blame, in Colorado, hail damage has increased along with the costs to repair roofs. Sometimes, it is not even about cost; it is that insurance companies stressed with the ever-increasing values of homes that are destroyed in natural disasters and are not renewing some home insurance policies. So far, American National is the only company leaving the state, but there is fear that other companies will be forced to increase fees or leave the state as they suffer huge damages from hurricanes and forest fires.

Colorado is launching its own homeowners insurance product in 2025 called the Fair Access to Insurance Requirements (Fair Plan) as insurance if no other companies will cover a home. Prices for these will be at least triple the industry average, but homes denied at least three times will be eligible for coverage.

– Jordan Hedberg