The great Charlie Munger, the investment partner of Warren Buffet, died in late November this past year, just a few weeks short of his 100th birthday. Munger’s clarity of mind garnered him a following that reached far outside the investment world. Fond of boiling down his mental models into concise heuristics, his pithy sayings became known as “Mungerisms.” The aphorism that has had my attention the past few months, or maybe decades, is: “People are trying to be smart—all I am trying to do is not to be idiotic, but it’s harder than most people think. *”

Something happened in modernity that Munger picked up in his 30s after a series of personal crushing blows. He noticed that our culture became obsessed with efficiency, focusing on the “best way” and smartest way to do things. This obsession with the “new” is still with us, and there is blind faith that the new will not have any negative side effects. What our culture has left in the dust is the concept of risks and opportunity costs, subjects that Munger spent his life mastering. Another version of the above Mungerism is, “It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent. There must be some wisdom in the folk saying: ‘It’s the strong swimmers who drown.’”

What Munger understood is that time was the biggest risk generator but also the greatest opportunity for success. Time works on human affairs much like gravity does for physical objects, exerting a consistent force that will separate the fragile from the robust. The risk expert (and successful trader) Nassim Nicholas Taleb identified time as part of what he called the “Disorder Cluster,” stating, “Time is functionally similar to volatility: the more time, the more events, the more disorder.+” Recognizing that time brings disorder that often wrecks the best-laid plans is the first step to finding ways to harness time for success.

The problem with accepting the notion that the world is much, much messier than we care to admit is that it can lead to a type of nihilism. Constant failure in daily life leads to resentment of a system that seems so unpredictable that even attempting to continue to have hope is met with cynicism. Intellectuals fall prey to despair even faster than laymen as many were taught by the extensive education they received, that there is meaning and order which often implodes the moment they come into contact with messy reality. But what is often missed is that Munger and Taleb are not arguing that planning is a useless exercise, but instead, that to be successful in a disordered world, you must have a really high filter before taking action and taking a risk.

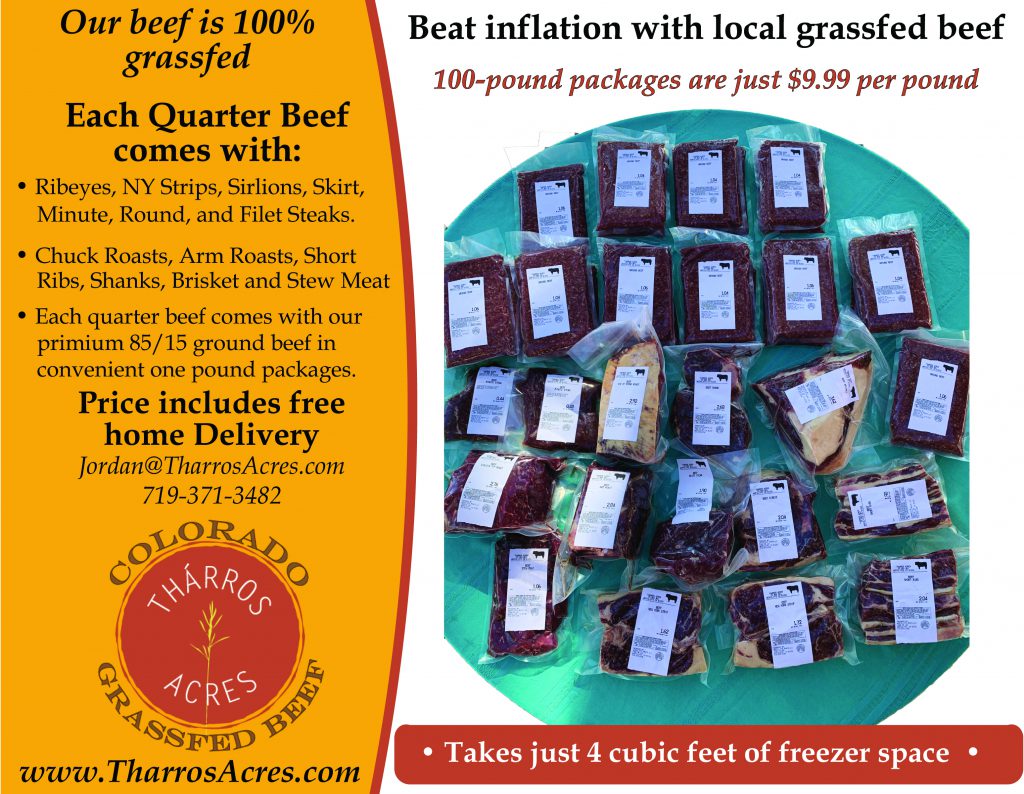

The late founder of Apple, Steve Jobs, understood that success over time has much more to do with saying no most of the time. “People think focus means saying yes to the thing you’ve got to focus on. But that’s not what it means at all. It means saying no to the hundred other good ideas that there are. You have to pick carefully. I’m actually as proud of the things we haven’t done as the things I have done. Innovation is saying no to 1,000 things.” A friend of mine and former resident of the Wet Mountain Valley, Tom O’Brien, put it more succinctly, “It’s good… but it is not great, but it is good.”

In business lingo, the opportunity cost of any decision must be carefully thought out as we are limited in time on the risks we can take. The only way to pick the best option is often not picking any option at the moment and waiting for something else that could be better. Of course, we don’t live forever. The trick is setting up the rules of when to take action. For Munger, it was doing research and identifying the companies that had the best free cash flow plus a solid business, and waiting for a time when the market overreacted and priced the shares of that company under what he thought reasonable. For Steve Jobs, it was constantly looking at new innovations and sorting through them until one seemed so foolproof and amazing that he jumped on developing it. For Taleb, the trick is simply knowing that the world is messy when most others think that it is orderly, and betting that eventually, weak things break over time, even if you don’t know exactly when they will break.

Right now, the Valley is facing many problems, and often, the solutions that leaders take on are shallowly mimicking what other communities are doing across the country. One example is that the courthouse is rapidly approaching 100 years old, and the solution to the Board of County Commissioners is to borrow tens of millions of dollars to build a state-of-the-art Justice Center without contemplating the opportunity cost of borrowing that type of money when it could be put to better use in a different manner. Another example is Silver Cliff, which is looking for more sales tax dollars by borrowing heavily and applying for grants to build a commercial town plaza. Westcliffe is paving streets at $60,000 a mile that serves less than a few dozen residential citizens in most cases. Round Mountain has decided the only way to pay for a new sewer treatment plant is through heavy borrowing and grants. The County fired one person for only having some of the experience they felt was needed as a County Manager, ignoring that what Braden Wilson currently lacked was more than made up for by his long-term commitment to the Valley and planning on earning his Master’s in Business Finance. And lastly, the school wrings its hands about declining enrollment and lack of teacher housing and hopes that some grants might come along that will solve the problem.

The problem with sunk borrowing and grants is that they take away options for the future. Large debt is the almighty destroyer of opportunity, and it locks people and communities into a bet that they can predict repayment over 30 years with near perfection. Maybe they get lucky, but history has proven that long-term prediction is not possible, and the opportunity cost of debt is monstrously expensive.

I will leave this editorial with one last way to look at the problem. Mark Spitznagle, the former hedge fund partner of Nassim Taleb, wrote a technical book two years ago about the idea of finding Safe Havens~ in the investment world. Spitznagle starts with the simple idea that “the cure of a disease cannot be worse than the disease itself.” Unfortunately, according to him, often in the modern world, the cure we prescribe to solve our problems is much worse than the disease itself.

In other words, when we sit down to solve problems as individuals or as a community, narrowly mimicking what the rest of the world does and not taking into consideration the risks involved regardless of how “genius” or “cutting edge” the solution may be, is a certain path on the road to ruin.

– Jordan Hedberg

* For the collection of Mungerisms read David Clark’s Tao of Charlie Munger: A Compilation of Quotes from Berkshire Hathaway’s Vice Chairman on Life, Business, and the Pursuit of Wealth.

+Many of the ideas on risk that I share with readers have origins in Nassim Nicholas Taleb and his works. I suggest starting with Antifragile: Things That Gain From Disorder.

~While I love Spitznagle’s book Safe Havens: Investing for Financial Storms I would recommend to the average reader his first book The Dao of Capital: Austrian Investing in a Distorted World which is a deep exploration on what Capital really means.