As the dust settles after the overwhelming defeat of Proposition HH at the ballot box and the subsequent Colorado legislative overturning of the voter’s choice with a bill that closely resembled HH, the effects of the property tax plan are starting to come into focus. However, the long-term consequences of the series of knee-jerk reactions by state leaders are relatively unknown, even to the sponsors of the property tax relief plan.

Locally, the 13 taxing districts in Custer County are seeing that while there will still be an increase in revenues, it appears that the amount received, at least at first, will be about 43% less than estimated at the start of the year.

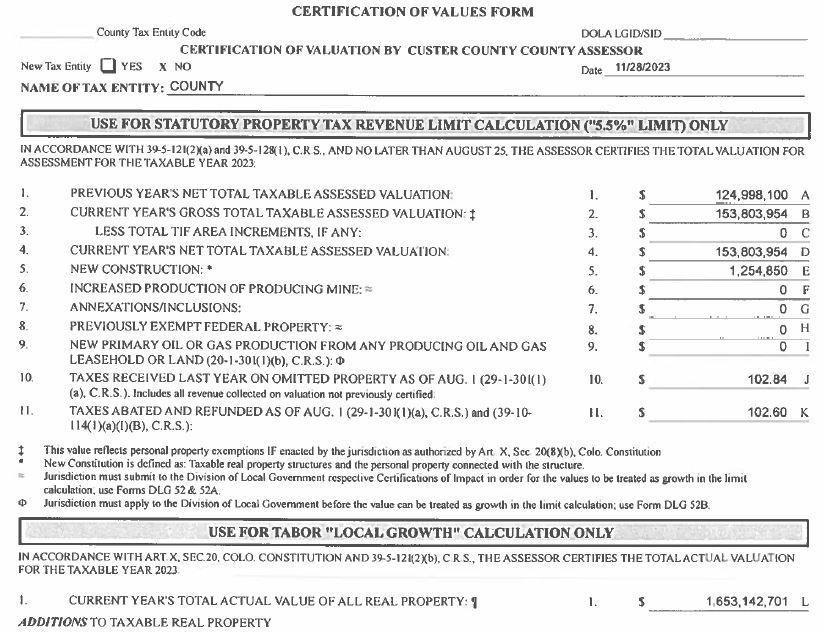

According to some early calculations compiled by Custer County Assessor J.D. Henrich, the county’s total taxable value fell by about 7.8 percent due to the actions taken by the legislature. Initially, it was estimated that the valuations had risen from $125 million to $166 million, a 25% from 2022. This 25% increase surprised many locals when they started to receive tax estimates earlier this year.

But with the laws passed by the Colorado Legislature, instead of the valuation of Custer County being $166 million, it falls to $153.8 million. This is still an 18.7% increase over 2022, and it does take the edge off the tax increases for the next two years.

Yet, while this might be good news for homeowners, the reality is that it limits the income that local taxing entities had been expecting. During a Board of County Commissioner meeting earlier this month, several local districts noted that these reductions come after years of being squeezed by inflation costs. West Custer County Hospital District Treasurer Barry Keene noted that his district was already treading water as costs skyrocketed the past two years, but funding and income stayed the same and even fell a bit in operations. The full tax increases would have gotten the district back to even, but now they might be facing another year of small losses in 2024.

In theory, the State of Colorado has said the difference from the valuation change will be “backfilled” by the State at the end of the year. However, it is unclear if this would violate the State’s Tax Payer Bill of Rights (TABOR) Constitutional Amendment. Often the voters of Colorado promise to fund local governments with various bills, but actually paying those bills is often never fully completed by the State of Colorado.

Over a decade ago, the State said they would fully fund schools with a formulation that voters voted yes on, but over ten years later, the State still has not come up with the total amount of funding. In theory, fire districts and health districts like West Custer County Hospital District will be compensated by the State for the lost tax revenues dollar-for-dollar, but many districts across the State are not counting on such funding coming to fruition.

While the State’s actions reduced property valuations across the State, Governor Jared Polis has been sending requests to special districts, including school districts, asking them to lower rates even further. “I signed a law that allows districts to do this on a temporary basis. That means if you cut your property tax rate, let’s say for some reason property taxes go down over the next two years or are steady, you don’t have to eat that cut or go back to your voters. You can float it back up, you have the flexibility to do that legally because we don’t want people to gamble their future just because of this really bizarre 40% increase that we’ve had over the past two years,” said Polis.

Custer County Commissioner Bill Canda has been making the same request to local taxing districts and will be bringing it up again during future BOCC meetings.

Over the next several months, districts will have their budgets in place, and the Tribune will report on the actual changes each faces and what they mean for the future of local services.

– Jordan Hedberg