For those who have lived in the area for more than a few decades they will always say that the economy in the Valley is a constant cycle of growth and decline. The unexpected growth during and after the COVID pandemic has yet to fall away, as had been feared by many businesses in the area. But while 2023 was another year of good economic performance, it was less strong than the 2021 and 2022 highs, and there could be signs of an economic slowdown as the local economy enters the slow winter months.

Real Estate

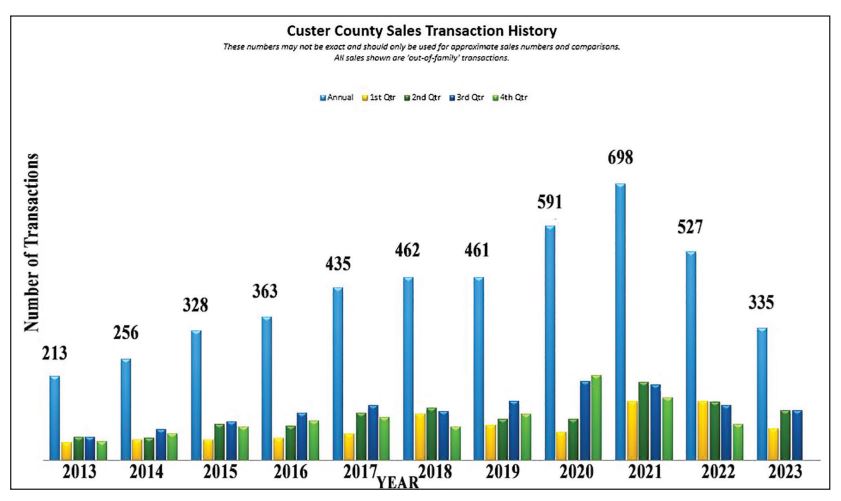

The absolute number of real estate transactions is going to be down in 2023, back to a level not seen since 2017, but this does not necessarily mean that the real estate industry is suffering. Real estate sales are the number one economic driver in Custer County in terms of total dollar value, and while the volume of transactions is down 23% for the first three quarters of the year, the prices of homes have stayed near their all-time highs seen in 2021.

According to data from Rocket Homes Real Estate, median home prices are up 1.9% since November of 2022 at $442,500. When interest rates were raised by the Federal Reserve over the past two years, housing experts feared that home prices would plummet as home affordability declined dramatically. However, this fear has not yet been realized, and that is a good thing for local real estate offices.

Several reasons for the surprising stability of housing prices have been floated. First, is that the economy has stayed strong in the United States as jobs and manufacturing are being relocated back to the nation for the first time since the Cold War ended. Another possible reason is that the ultralow interest rates during 2020 and 2021 have created a condition known as “Golden Handcuffs.” This is where homeowners with mortgage rates of under 4% are reluctant to sell and relocate, as interest rates on 30-year mortgages have risen to 7.5% as of this writing.

However, according to local real estate offices with which the Tribune has spoken, the main reason that prices have remained stable is the low inventory availability of existing and new homes listed on the market. While the Golden Handcuffs might have a role to play, the low inventory availability is driving the gain in real estate values against earlier predictions of declining prices.

According to the same report by Rocket Homes, there are currently 92 homes for sale on the market, which is well below the ten-year average of 150 homes for sale. Note this number does not include vacant land; the real estate listing site Zillow shows there is a total of 282 homes and vacant lots for sale within the 81252 zip code. The only thing that has changed dramatically is that homes are no longer being sold at over-asking prices in the region. In 2020 and 2021, bidding wars for real estate were common. So far in November, six homes out of eight have sold at or below the asking price. However, the price reductions are minimal and demonstrate that sellers are starting to wrap their minds around high prices, but there are no bidding wars like there were during the pandemic.

Construction

Home building in the Valley is the largest job sector in Custer County and is tied closely to real estate sales. Much like real estate sales, the number of new building permits for homes is down over the peak in 2021, but that does not mean the industry is in distress. Before the pandemic in 2019, there was a total of 77 new dwelling permits in rural Custer County (this does not include buildings within the two towns of Westcliffe and Silver Cliff). By 2021, it was 103. As we enter the last month of the year, new dwelling permits are at just 57, almost half of what they were two years ago.

But the twist is that during the past several years, a large backlog of homes was created, with builders scheduling projects several years in the future. While new permits are down, home construction is still trying to clear the backlog that was created from the large influx of people wanting to retire in the Valley. Construction supply shortages also added to this backlog, delaying the completion of homes as builders waited for everything from windows to bathtubs. According to builders with whom the Tribune spoke, the supply backlog has finally started to resolve, but prices of construction materials remain elevated, even if prices have stopped increasing. But the waiting list still runs several years into the future, and while builders have started to nip away at their schedule, it is likely it will be years before builders catch up with the pent-up demand for new homes.

One wrinkle of the construction numbers is that for the past several years, Round Mountain Water and Sanitation District has had a moratorium on new water and sewer taps as the district struggled with a failing wastewater system. While there were still taps outstanding on lots that builders could build on, it is clear that the number of homes that could have been built during this timeframe was severely curtailed. Round Mountain announced recently that it hopes it will end the moratorium in January, as repairs and new systems have helped, and they are confident that it will start construction on a new water treatment system this coming year. The demand for relatively affordable lots within the city limits is still high, but buyers have been reluctant to take the risk as long as the tap moratorium has remained in place.

Westcliffe Sales Taxes

There is a misconception that tourism is one of the largest industries in Westcliffe, but in terms of economic revenue creation, it comes in a distant fourth or fifth after real estate, construction, government employment, and agricultural production. But the extra bump that tourism does have in the summer months is what can make or break small businesses on Main Street. Fortunately, sales tax numbers from the town of Westcliffe show that there has been a steady increase in business since 2019. Numbers through September this year show that sales taxes collected are up 7.67%. While there has been no growth in July through September, the town is in a position to bring in a record amount of sales taxes of over a million dollars by the end of the year.

One nuance in the numbers from 2019 is that in 2021, the city started to collect an additional 1% sales tax to pay for infrastructure projects within Westcliffe. Silver Cliff also increased its sales tax by 1% the same year. But even taking into account that sales tax increased from 2% to 3%, town sales tax revenue has increased by 45% from 2019 to 2022. This has matched the rate of inflation over that same period.

– Jordan Hedberg